The Evolution of the Tax Professional Starts Here

The tax prep business is changing rapidly. It used to be that technology helped you do your job more efficiently. But now, technology and artificial intelligence are conspiring to do your work for you. This is turning your business into a commodity, eroding your margins, and jeopardizing your value.

We empower the tax professional to operate at the center of their client’s financial lives and extend their influence and expertise far beyond the tax return.

- Our proprietary AI software is the leading proactive tax planning software platform in the tax business.

- Our online portal provides technical training, client-facing tax planning materials, implementation guides, education, and coaching.

- We are the largest network of proactive tax professionals across the US that come together to share best practices, develop their skills, and collaborate.

- We host technical tax training and implementation training, a weekly business development masterminding call, and a private Facebook group.

- We create and deliver thoughtful commentary on trends and current events (as they relate to taxes) and issues facing the tax professional and their clients, so you don’t have to.

99¢ for the First Month of Basic Membership!

Try the first month of Basic Membership for 99 cents. This is not a trial, you get full access to all membership benefits. The regular price of $99 resumes after the first thirty days. Cancel any time.

Here's What Comes With Basic Membership

1. Tax Architect® AI Software

Dozens of automated tax-planning strategies that can grow your business and save your clients THOUSANDS of dollars

Many new members join Tax Master Network specifically so they can put Tax Architect to work for their clients. But if that’s all you see, you’ll be missing a lot! You can go months without using the Tax Architect software and still get value from the rest of your membership.

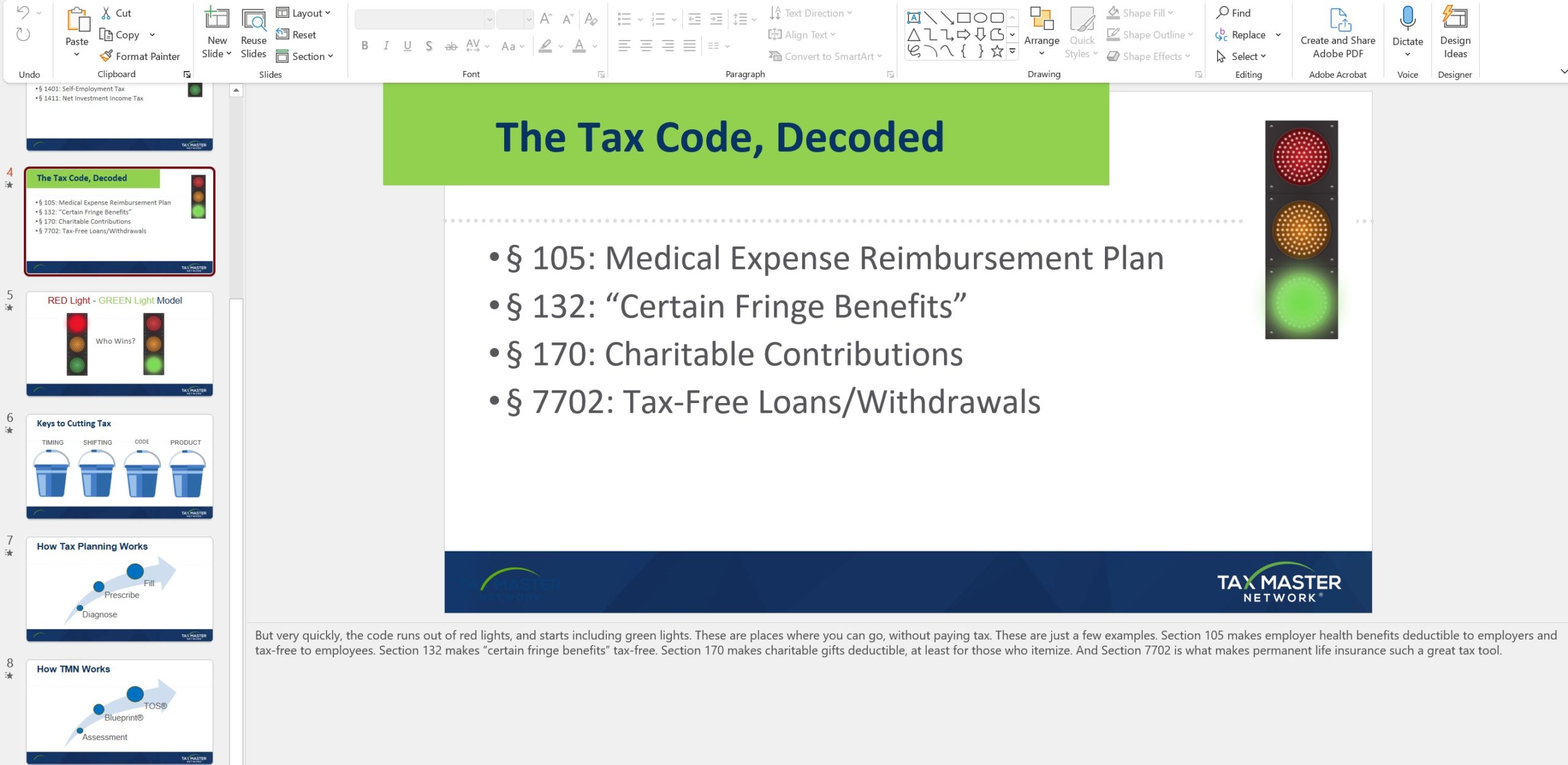

The Tax Architect is the foundation of the Tax Master Network system. The software uses a proprietary “artificial intelligence” to choose from over 130 specific, proven tax-saving strategies, based on the client’s unique circumstances. It packages those strategies into a tax plan report tailored to your client. (Of course, you can override and customize each report as you see fit.)

This isn’t a spreadsheet. It’s a plain-English presentation tool. It explains to clients what the spreadsheets mean to them, without burying them in detail. It tells them exactly what to do to realize savings. (Of course you can always supplement TMN plans with spreadsheet projections.)

The plan starts with a Tax Blueprint® Summary Report outlining the most promising strategies. Each strategy includes a savings estimate to help prioritize which to implement first. You’ll also find a total savings summary. You can even show your client their one-year and five-year ROI on your planning fee!

The Tax Blueprint® Detail Report includes a series of one-page modules going into more detail on each recommendation. Modules include easy-to-understand examples, charts, tables, and graphics. They’re fully sourced and footnoted to the Internal Revenue Code, Treasury regulations, and other appropriate sources.

Each page is personalized for you and your client. And each plan includes a custom cover page, table of contents, and an “About the Planner” page you can customize with your photo, logo, and biography.

If you’re not yet confident in your ability to prepare a plan on your own, you can outsource it to us! We’ll collaborate with you to develop the plan, coordinate with you before delivery, and even deliver the plan with you. Many members have used this service to complete their first few plans while they develop the confidence to prepare and deliver them on their own.

2. Technical Training Center

Learn How to Deliver Tax Planning

- Training Video

- Client Facing Power Points

- White Papers

- Implementation Guides

The Technical Training Center is your foundation for understanding how tax planning works and how to harness its power for your clients

3: Turnkey Business Training

Building a planning-oriented business involves different challenges than building a tax-prep business. Fortunately, we’ve “cracked the code” to help you accomplish that goal. Our turnkey Business Development Center includes presentations to help you target the right markets for your new service, attract and retain higher-income clients, develop high-value client experiences, and eliminate cold marketing in favor of high-touch referrals.

4: Weekly Mastermind Call

Live Coaching and Business Development

The Weekly Masterminding Call is your weekly forum for all things business development: marketing, sales, pricing, and practice management. You’ll join dozens of fellow TMN members to share questions, vent frustrations, and even brag about your successes. CEO Ed Lyon moderates the call and offers his wisdom from 17+ years of experience helping tax professionals build the sort of business you’re looking to build. But the real insight comes from fellow members succeeding at it right now. This hour may quickly become your favorite hour of the week!

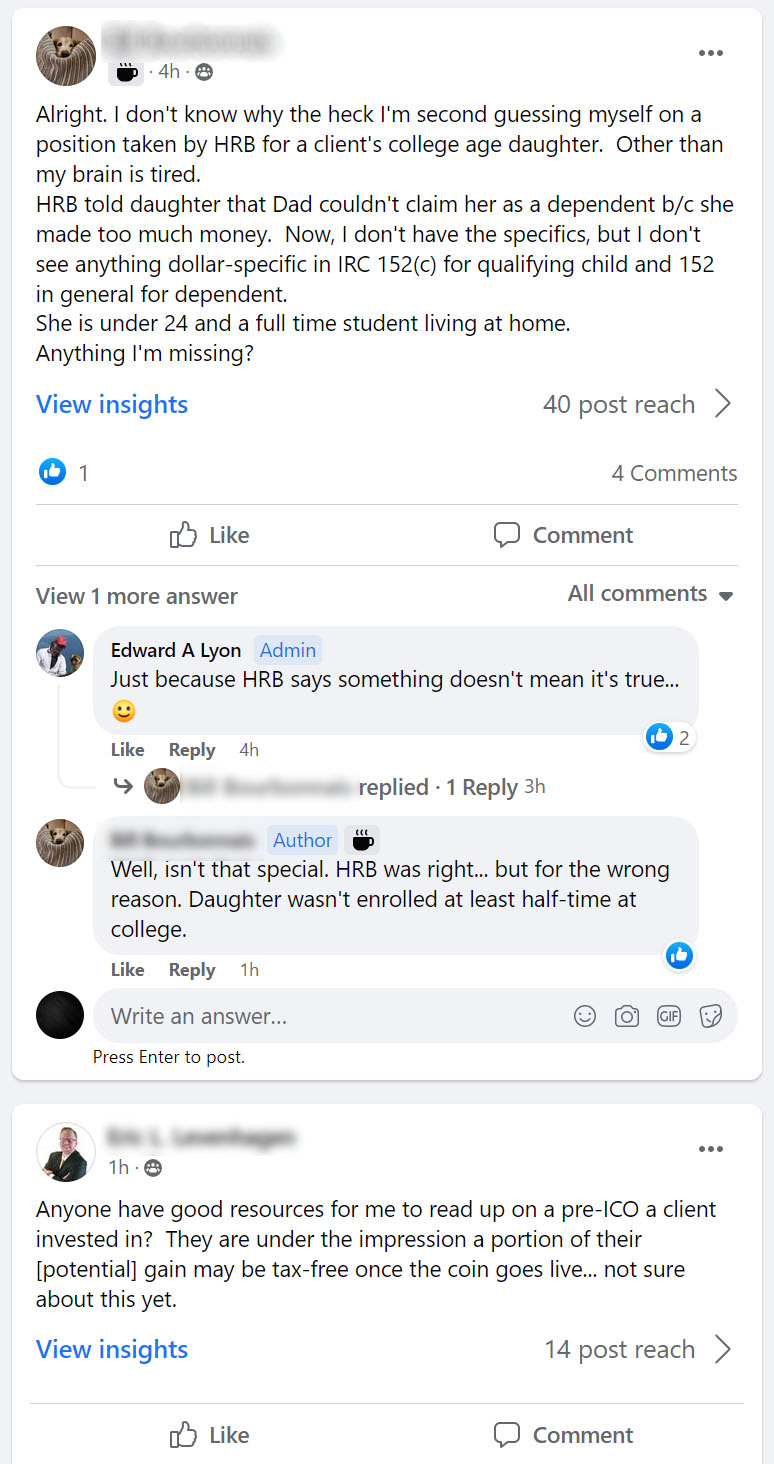

5: Private Facebook Page

Network with Tax Professionals

A professional network dedicated to lowering taxes and increasing profit. Tax Master Network members enjoy access to this private group where tax professionals can network and discuss all things tax.

6: Annual Conference Invitation

The Evolution of the Tax Professional Conference

Exclusive invitation to our annual conference, The Evolution of the Tax Professional, where like like-minded proactive tax professionals network and learn

99¢ for the First Month of Basic Membership!

Try the first month of Basic Membership for 99 cents. This is not a trial, you get full access to all membership benefits. The regular price of $99 resumes after the first thirty days. Cancel any time.

Tax Master Network Works for You

Justify Premium Fees

Like it or not, tax preparation is a commodity business. Clients can always find someone faster, cheaper, or more convenient. This makes it hard to justify premium fees.

If your client thinks you and your competitor deliver the same service, you’re both “apples.” And apples-to-apples comparisons make it hard for you to charge more.

But if your client sees you deliver more, you’re no longer an apple. Now you’re an “orange.” Now you can use an apples-to-oranges comparison to set whatever fee you like. Who cares what your “competition” charges if they can’t actually compete?

TMN stacks the deck in your favor. It gives you the extra value you need to avoid those apples-to-apples comparisons.

Generate Year-Round Income

Traditional tax preparers don’t have much to offer outside “the season.” (Remember Jeopardy champion Ken Jennings? His amazing run ended when he couldn’t identify H&R Block as the company whose 70,000 seasonal white-collar employees work just four months a year.)

You can meet a new client in August and wait months to get paid for filing his return next April. It doesn’t matter how impressive you are if your job doesn’t start ’till the season.

Or you can use TMN . . . prepare a written plan for whatever fee you choose to charge . . . impress him enough to refer two more clients in time to get paid long before they ever engage you to prepare a return.

Boost Loyalty

TMN clients know you’re not just dropping the “right” numbers into the right boxes on the right forms. They know you’re working year-round to save them money, in all areas of their finances.

This means better clients – loyal clients, willing to pay premium fees, not lured away by your competitor with the closer office, the cheaper price, or the longer hours. When someone asks if their tax pro has ever come to them and said “here’s an idea I think will save you money?” you’ll be bullet-proof.

Increase Referrals

TMN clients save money – sometimes big money. That doesn’t just boost client loyalty.

TMN turns clients into raving fans, happy to refer you to friends, family, and colleagues. And clients generally refer “up”, which boosts your business even more.

Introduce Lucrative Family Office Services

If you’re already running a successful tax practice, you have the most important thing you need to succeed in financial services – the clients! What do you think will be the easier way to expand your business? Finding more clients for the things you’re already doing? Or finding more things to do for the clients you already have? Experience tells us it’s the second.

Expanding your business to include financial services sounds intimidating at first. But TMN offers a unique, done-for-you system to take advantage of your “most-trusted professional” status and build your confidence fast. Our multifamily office charter works to earn you an extra $250,000 in revenue in your first year in the business.

By now you’re probably worried about how much all this costs.

After all, comprehensive tax-prep suites cost at least $1,000, and in some cases more than ten times that. And that just gets you in the game.

You’ll be pleased to discover that TMN guards your marketing dollars as jealously as it guards your clients’ taxes.

Basic membership is just $99/month, billed automatically to your credit card. Generate as many clients and plans as you like for the same all-inclusive membership. That’s less than $3.41/day for the most powerful business-development system you can have.

There’s no long-term commitment — you can cancel anytime.

How many new clients do you need to attract to justify your investment?

You can pay for an entire year’s membership with a single client. But don’t think in terms of recouping your investment. Think of multiplying it by dozens or even hundreds of times. There’s just nothing else like TMN.

Are you ready to take the next step?

In less time than it took to read this letter, you’ll have access to a unique suite of tools to build your business, your fees, and your referrals. Save your clients a fortune and have them sing your praises.

Are you serious about growing your business? Then how can you say no? Try it today, and soon you’ll need some TMN planning strategies for yourself!

99¢ for the First Month of Basic Membership!

Try the first month of Basic Membership for 99 cents. This is not a trial, you get full access to all membership benefits. The regular price of $99 resumes after the first thirty days. Cancel any time.

About the Founder, Edward A. Lyon, J.D.

Tax Master Network founder Ed Lyon has written nearly a dozen books on taxes and tax planning. He writes two weekly tax columns for over 100,000 tax professionals and their clients, making him one of the most widely-read tax strategists in the country. He’s the creator of the Tax Architect AI Software (previously TaxCoach Software) and speaks regularly to audiences of tax professionals and business owners. He’s appeared on over 500 television and radio broadcasts, including CNN, Fox News, MSNBC, and CNBC.

Ed has nearly three decades experience in the tax and financial services industries, where he focuses on helping business owners take advantage of the tax code’s legal, moral, and ethical strategies to pay less in taxes. He currently serves as Chief Tax Strategist for Financial Gravity Companies, Inc. (OTCQB:FGCO)

Ed Lyon earned his BA from Hamilton College and his JD from the University of Cincinnati College of Law, where he served as Executive Editor of the University of Cincinnati Law Review.